December 18, 2020 I Pandemic Stories

Armadillo Reports 23% Sales Increase YoY for 2020

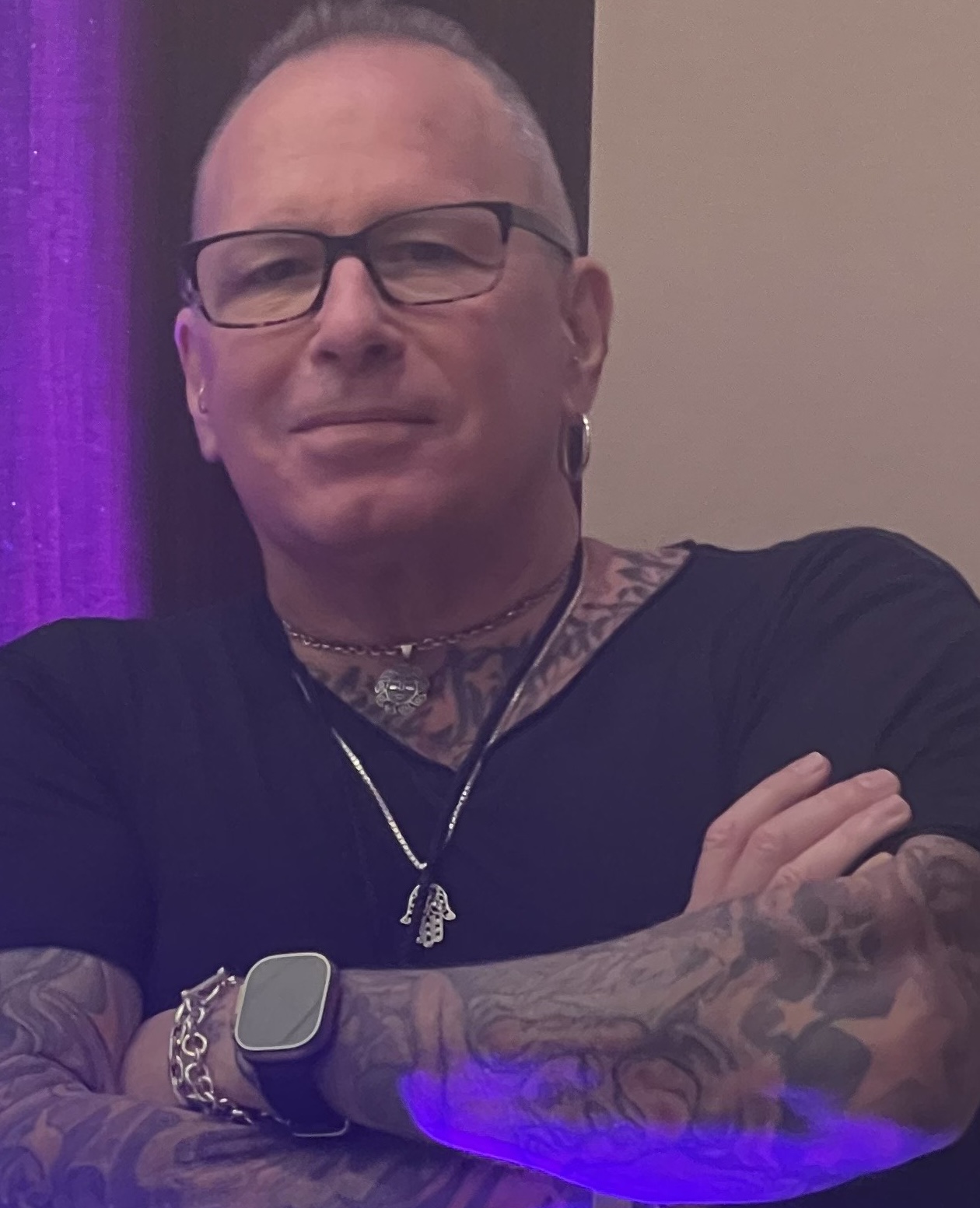

Evan Rubinson

Tampa, Florida-based Armadillo Enterprises’s pandemic experience this year is a familiar one. Beginning in March, its brands, Dean, Luna and ddrum, saw an increase in sales, particularly in what Armadillo CEO and President Evan Rubinson calls “particular categories that really cater towards newcomers.” But, he notes, Armadillo’s high-end products also performed well this year. “I attribute that high-end success largely to a lot of these gentlemen, and women as well, who are doctors, lawyers, accountants, and are sitting home, they’re going, “I would love to have a new guitar to do something during my quarantine time.’”

Because of all this, according to Rubinson, Armadillo can report a 23% sales increase year over year. “That’s pretty material for an industry that is fairly stagnating,” he said. “Unless you acquire a company, typically you’re not going to see over a 10% sales increase.”

Smartly, Rubinson’s preparing for the bubble to burst.

“I sat down when we did our forecasting with my supply chain guys, product managers and our sales guys, and I said, ‘Look, we can’t necessarily expect this to continue because if things do open back up and there are vaccines, there inevitably will be a paradigm shift,” he said. “I do think that there will be a drop-off as the vaccine comes out as people go back to taking vacations and being able to go out on the boat and do other things that are an expenditure of cash.”

He’s hopeful to find a hybrid between pre-pandemic sales levels and the quarantine-inspired sales boom. “Maybe that 23 percent uptick settles out at a baseline of a 10- or 15-percent uptick.”

Most companies in MI have dealt with supply problems during the pandemic, and Armadillo was no exception, as production shutdowns affected the industry worldwide. The company had been doing 90% of its production overseas in India, China, Indonesia, Korea and beyond.

“But I’ve made a big push for a top-down marketing effort and a top-down sales effort if we want to be a quality-focused brand,” Rubinson said. “And so that being the case, I’ve really tried to ensure that we are getting out of the markets that may not be the best and that we’re really pushing our U.S. production. So that 90-10 metric went to about 82-18 over the last year.”

Can Armadillo continue to shift that metric? According to Rubinson, it comes down to some factors beyond his control. “A big part of that has to do with government regulation tariffs, the new administration with Biden coming in and what exactly they’re going to do in terms of foreign trade policy and specifically China policy,” he said. “I do see a trend of a nationalistic approach where every company that’s headquartered in a country is being a bit more nationalistic and self-sufficient.”

While it looks at shifting production, Armadillo is also taking a careful look at where it distributes and sells its products and why. “My sales department, of course, mentioned to me that it’s much more profitable to sell all of this into the U.S. and I said, ‘Yes, I agree in theory, but I don’t want to lose market share in foreign markets,’” he said. “We’ve had a little bit more of a focus on domestic, but overall it’s been a pretty equilateral spread.”