News

March 04, 2026 I Closure

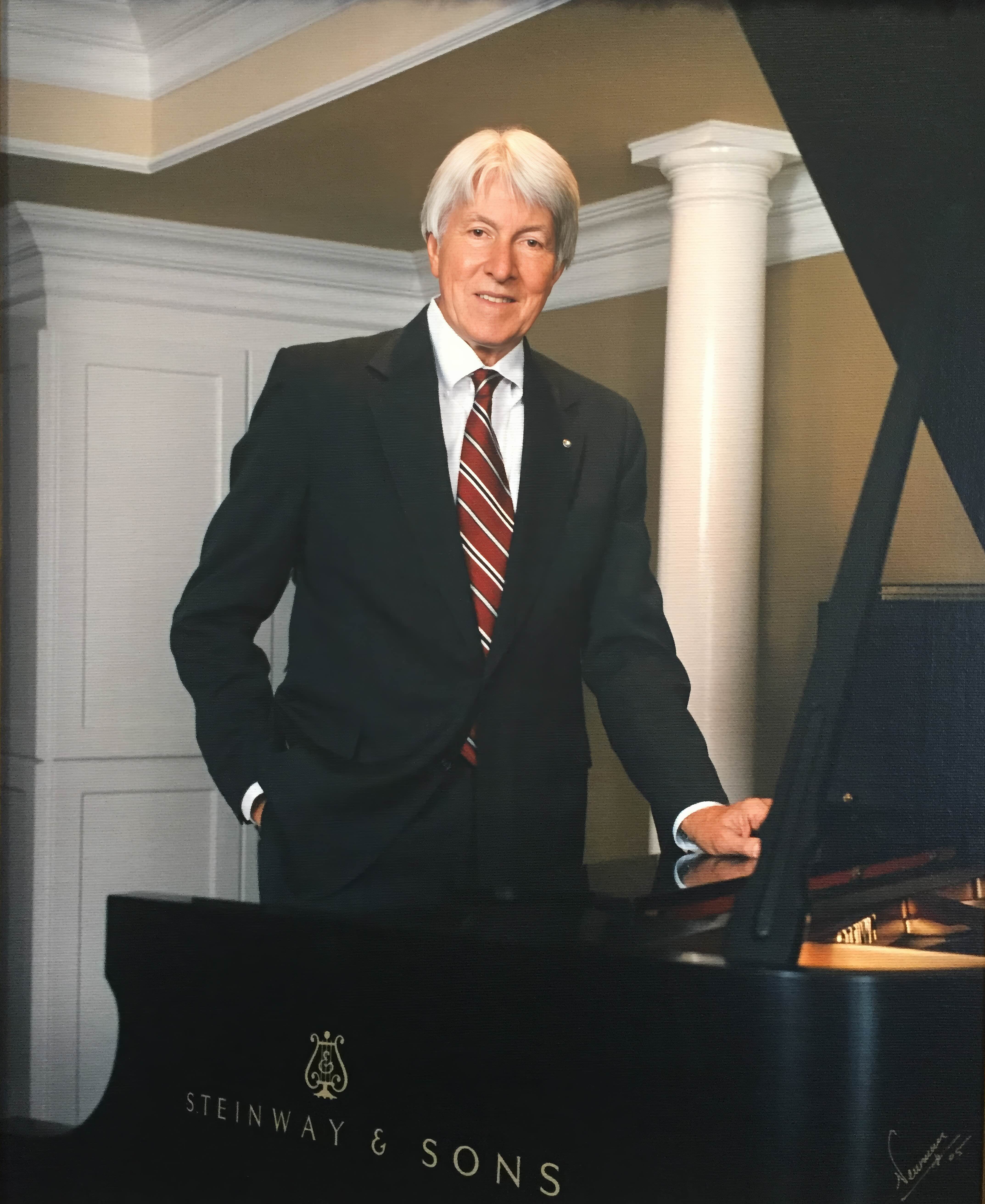

Daynes Music to Close After 164 Years

Founded in 1862 by John Daynes in a log building in downtown Salt Lake City, the company became Utah’s oldest continuously run family business and one of the nation’s longest-standing music retailers.

March 02, 2026 I Distribution

Yorkville Adds 3 Brands to Distribution Portfolio

The company is now the Canadian distributor for Spector Musical Instruments, Aguilar Amplification and Darkglass Electronics.

March 02, 2026 I Appointments

NAMM Promotes Erin Block to Director of Data, Analytics

The 23-year NAMM veteran will oversee the organization’s new data and analytics department.

March 02, 2026 I Appointments

Samson Appoints Ty Vaughn as Head of Product Development

In his new role, Vaughn will lead the company’s product development strategy, overseeing every stage of the product lifecycle across Samson and its distributed brands.

March 02, 2026 I Appointments

KHS America Promotes Aldrich, Rehnborg

Bailey Aldrich will become the senior marketing and event specialist, while Ryan Rehnborg to creative and marketing communications manager.

March 02, 2026 I Supply

Elrick Bass Guitars Relocates to Valencia, Spain

The relocation to Valencia will help Elrick Bass Guitars strengthen its connection to the rapidly expanding European and Asian markets.

February 25, 2026 I Closure

Steve’s Music Store Announces Closures, Liquidation Sales

Steve’s Music Store has announced it will be closing several of its stores, with only the original Montreal location expected to remain open.

February 24, 2026 I Partnership, Philanthropy

Sweetwater, Yamaha Launch $25K Giveaway to Support School Music Programs

Music educators can enter at more than 16 events nationwide for a chance to equip their students with Yamaha instruments and technology.