News

February 25, 2026 I Closure

Steve’s Music Store Announces Closures, Liquidation Sales

Steve’s Music Store has announced it will be closing several of its stores, with only the original Montreal location expected to remain open.

February 24, 2026 I Partnership, Philanthropy

Sweetwater, Yamaha Launch $25K Giveaway to Support School Music Programs

Music educators can enter at more than 16 events nationwide for a chance to equip their students with Yamaha instruments and technology.

February 24, 2026 I Legal, Retail

Martin Guitar Worth $15K Stolen from Music Land

The stolen guitar was a 1947 Martin D-28 guitar valued at $15,000 on Feb. 10.

February 23, 2026 I Legal

NAMM Welcomes Supreme Court’s Ruling Invalidating IEEPA Tariff Authority, New Tariffs Announced

NAMM responds to the Supreme Court’s ruling and experts weigh in. This is a developing story and will be updated as more information becomes available.

February 18, 2026 I Partnership

Guitar Center Named Official Music Gear Retailer, AV Integrator for Titans’ New Stadium

The partnership includes the NFL’s first in-bowl performance stage, Guitar Center-supplied gear and new community music initiatives.

February 16, 2026 I Anniversary

Grand Ole Opry Partners with Martin on Opry’s Limited Edition 100th Anniversary Guitar

Opry member Vince Gill was the first artist to ever play the one-of-a-kind instrument when the guitar was introduced to the public for the first time in late 2025.

February 16, 2026 I Obituary

The Music People’s Founder Jim Hennessey Passes Away

Hennessey founded The Music People in 1979 after identifying a need for better, more practical solutions for musicians and went on to found the On-Stage brand.

February 10, 2026 I Appointments

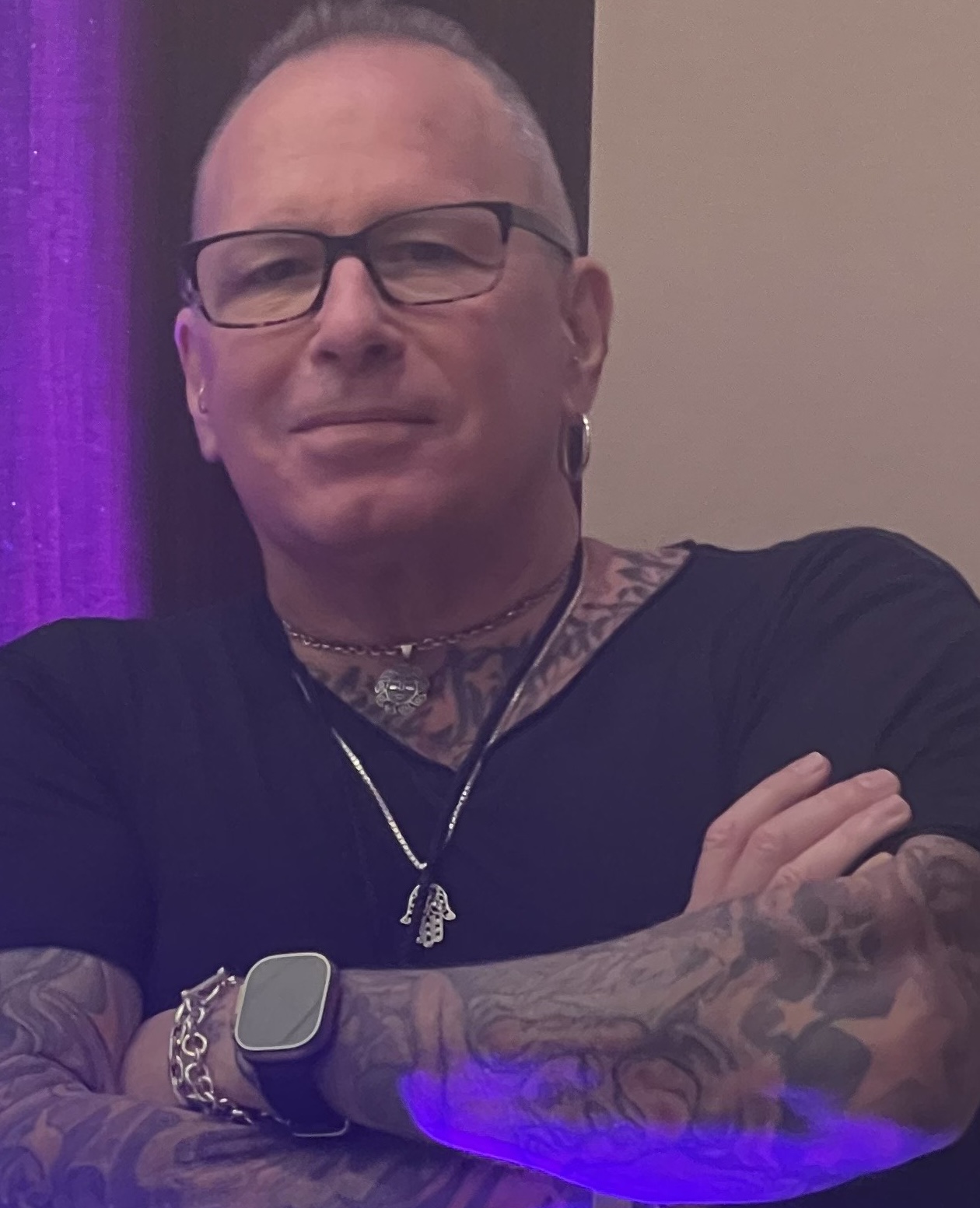

JAM Industries USA Appoints David Ungar Head of Artist Relations

Ungar will lead artist and entertainment relations initiatives across the company’s portfolio of musical instrument brands.